Stop digging your own grave.

Healthcare is affordable now!

Updated on Dec 13, 2022 at 03:59 PM

Affordable Care Act (ACA)

When it comes to the Affordable Care Act (ACA), the most common question asked is whether or not a business will be subject to a penalty under their current management of employee health insurance.

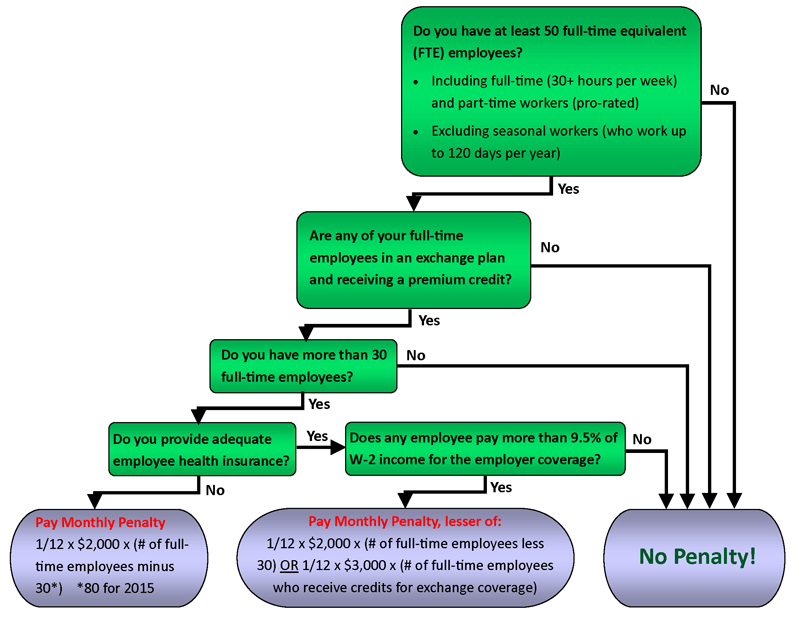

The following flowchart provides a quick and easy determination:

The FTE Count

We start with the basis that the penalty only kicks in for large employers. A large employer is defined as one having greater than 50 Full-time equivalent (FTE) employees. What is a Full-time equivalent? Click here for the official IRS definition.

Generally speaking, an FTE is determined by counting any employee that works on average of 30+ hours per week as 1. Then, add up the hours worked by an employee who works less than 30 hours per week and dividing this total by 30. Add those two totals together and that is your FTE. Of course there are many exceptions and considerations, so be sure you read the IRS publication we've linked you to in the previous paragraph.

Avoid Penalities

Once a business is determined to be large there are two quick ways out of a being penalized:

- If no full-time employee is in an exchange and receiving a premium credit, then no matter what the size of the employer, there would not be a penalty imposed. This provision is found in §4980H of the Internal Revenue Code.

- If the employer has less than 30 full-time employees (not to be confused with Full-time equivalent), then there would not be any penalty. There is no penalty imposed on employees not classified as full-time.

If the business has not found a way out of a penalty at this point, and adequate* employee health insurance is not provided, then the subject penalty is $2,000 annually for each full-time employee in excess of 30 full-time employees. The penalty is actually determined on a month by month basis at the rate of 1/12th of the $2,000 annual amount.

* Coverage is considered adequate if the plan’s actuarial value (i.e., the share of the total allowed costs that the plan is expected to cover) is at least 60%. The insurance must also be available to the employee’s dependent, which is defined as a child that has not attained the age 26 (a spouse is not considered a dependent.)

Affordability

If the business does provide employee insurance then the "Affordable" part of the Act comes into play. Under the ACA, coverage is affordable to a particular employee if the employee’s required contribution to the plan does not exceed 9.12% of the employee’s household income for the taxable year 2023. As an employer is not able to determine household income of an employee, a provision has been made that the employees W-2 Box 1 income would be used to determine affordability. The affordability test is based on the deduction attributable to employee only coverage. If any deduction is made for spouse and/or dependents, then that would be excluded from this affordability test.

An employer failing the affordability test would be subject to a penalty calculated the lesser of: $2,000 x (# of full-time employees less 30) OR $3,000 x (# of full-time employees who receive credits for exchange coverage). This penalty is determined on a monthly basis by performing this test and taking 1/12th of the respective amounts above.

For more information on this subject, consider visiting either of the following pages:

- Patient Protection and Affordable Care Act from the US Department of Labor

- Affordable Care Act Tax Provisions from the IRS